/

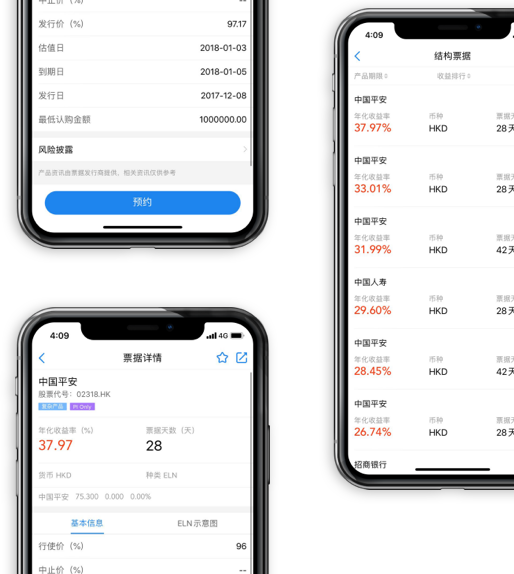

A structured note is an investment product that includes derivatives with different payoff structures linked to different underlying financial products which covers a variety of asset classes to meet experienced professional investors’ personalized investment needs. An Equity Linked Note (ELN) linked to a single stock or basket of stocks is a common structured note. ELNs are an investment tool that earn a high rate of return linked to the performance of underlying stocks, offering investors the opportunity to earn a higher rate than through investment in the money market. Credit Linked Notes (CLN) are linked to the credit quality of a company or a group of companies.

GF Securities (Hong Kong) offered structured note transaction are mainly issued by an investment grade credit rating global financial institutions.

- STEP 1

Open a securities trading account with GF Securities (Hong Kong), complete the Risk Assessment Questionnaire and Form W-8 and apply to be a professional investor.

- STEP 2

Ask your investment advisor for quotes for the notes.

- STEP 3

Place your order by completing and signing the structured product subscription form or by phone call.

- STEP 4

The transaction details will be confirmed with the client via recorded phone call on the date of order and final terms and conditions will be confirmed with the client via email on T+2.

- STEP 5

Relevant payment will be made by debit on your equity account within 7 days or 14 days (depending on the product terms) after the transaction is confirmed.

Viewthe fee details

Equity Linked Note (ELN), Knock-out Equity Linked Note (KOELN),Fixed Coupon Note (FCN), Bonus Certificate & Capital Return Note (CRN)

Credit Linked Note (CLN), Index Linked Note (ILN) & Commodities Linked Note

Fund Linked Note (FLN) & Shark Fin